What Happened

AST SpaceMobile Inc. (ASTS) has recently shown positive trends in its stock performance, with shares rising by $0.77, or approximately 2.11%, bringing the stock price to around $37.24. This uptick in value is accompanied by significant activity in the options market, where 91,000 contracts were exchanged, indicating a bullish sentiment among investors. The prevailing trend in the options market has been characterized by a higher number of call options compared to put options, resulting in a put/call ratio of 0.33, which is lower than the typical ratio of 0.43. Additionally, the implied volatility of the stock has increased, suggesting heightened expectations for price movement.

Analysts have provided a generally optimistic outlook for ASTS, with a consensus average price target of $41.77, indicating a potential upside of 12.59% from the current trading price. The company has also received a favorable recommendation from brokerage firms, with an average rating of 2.1, which suggests an “Outperform” status on a scale where 1 is a strong buy and 5 is a sell.

Key Details

- Stock Performance: ASTS shares increased by $0.77 to approximately $37.24.

- Options Market Activity: 91,000 contracts traded, with a put/call ratio of 0.33, indicating bullish sentiment.

- Implied Volatility: Currently at 88.77, up by 9.6 points, suggesting increased expectations for price movement.

- Analyst Price Targets: Average target price of $41.77, with a high estimate of $64.00 and a low of $30.00.

- Brokerage Recommendations: Average rating of 2.1, indicating “Outperform.”

- Business Developments: Plans for five satellite launches over the next 6 to 9 months, with over 60 satellites expected to be deployed by 2026.

- Financial Position: Cash reserves reported at $874.5 million as of the end of Q1 2025.

Multiple Perspectives

The recent performance of AST SpaceMobile has garnered attention from both investors and analysts. Proponents of the stock highlight the company’s ambitious plans for satellite launches and its strong cash position, which could facilitate further growth and development. The successful execution of these plans is viewed as critical for the company’s future revenue generation.

Conversely, some analysts express caution regarding the company’s rising costs associated with satellite launches and materials, which have increased the cost per satellite to between $21 million and $23 million. This could impact profitability, especially as ASTS is still in a pre-monetization stage with limited revenue. Additionally, uncertainties surrounding the successful deployment of their Block 2 Bluebird satellites raise questions about the company’s ability to meet its revenue targets.

Context & Background

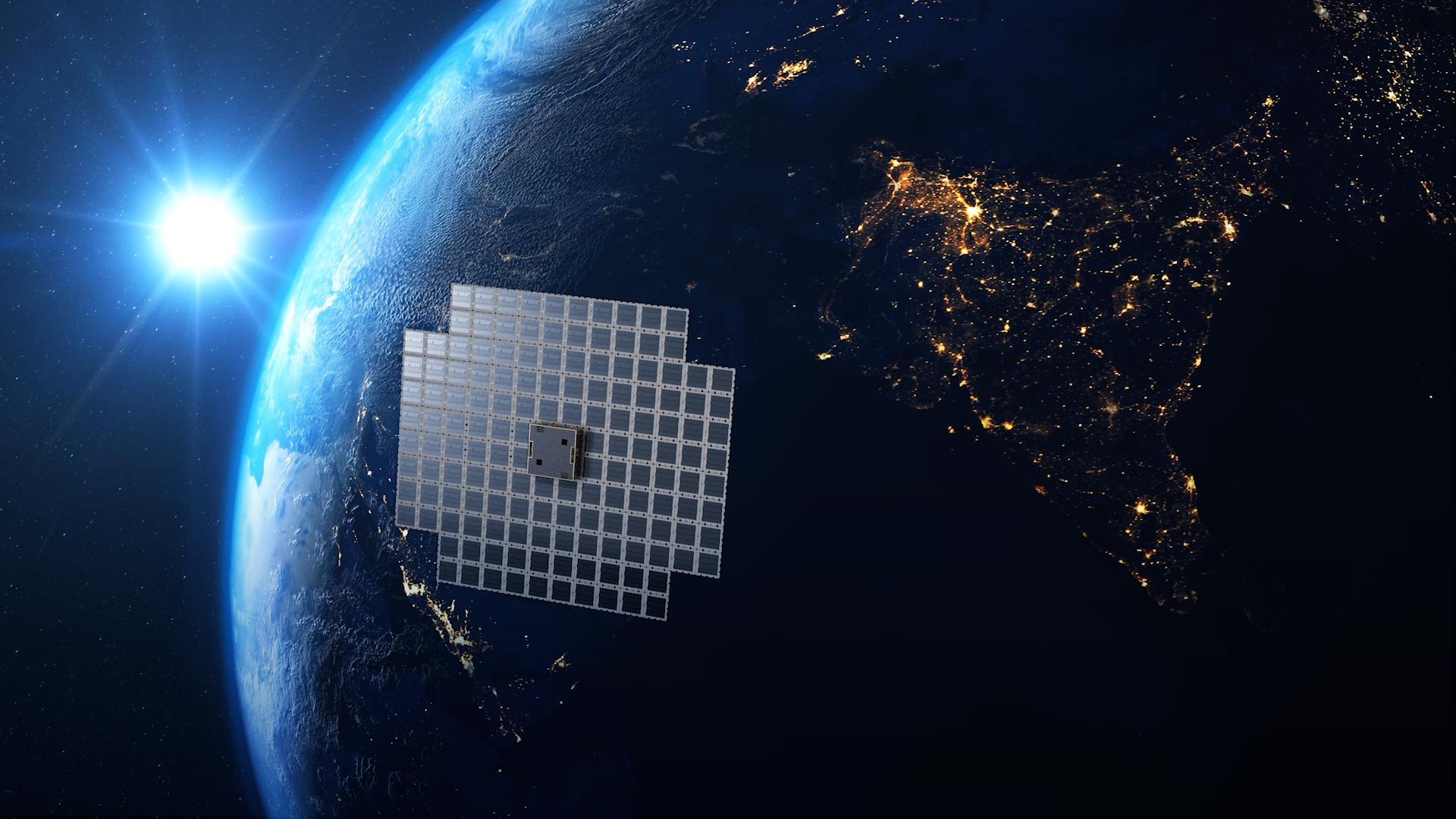

AST SpaceMobile is a technology company focused on providing space-based cellular broadband connectivity. Its innovative approach aims to bridge the connectivity gap in underserved areas by deploying a network of satellites. The company’s strategy includes partnerships with government agencies, as evidenced by a recent $43 million contract with the US Space Development Agency, which underscores the government’s interest in their technology.

The satellite communications market is rapidly evolving, driven by increasing demand for connectivity in remote areas and advancements in satellite technology. ASTS’s plans to launch multiple satellites in the coming years are positioned to capitalize on this trend. However, the company faces challenges, including higher launch costs and the complexities associated with satellite deployment, which could affect its operational and financial performance.

What We Don’t Know Yet

While AST SpaceMobile’s recent stock performance and business developments indicate a positive trajectory, several uncertainties remain. The successful launch and deployment of the planned satellites are critical for achieving the company’s revenue targets, and any delays or failures could significantly impact investor confidence and stock performance.

Additionally, the long-term sustainability of the company’s financial position is uncertain, particularly in light of rising costs and the pre-monetization status of its operations. The market’s response to future earnings reports and operational updates will be crucial in determining the stock’s trajectory.

Investors and analysts will be closely monitoring ASTS’s upcoming satellite launches and any developments related to its contracts and partnerships. The company’s ability to navigate the challenges of the satellite communications industry will ultimately shape its future prospects.